MRO Inventory Optimization for Oil & Gas – Reduce Downtime Without Overstocking

In the oil & gas industry, downtime isn’t just costly – it’s catastrophic. A single day offline can cost hundreds of thousands in lost production, labor inefficiency, and missed delivery targets. Yet many organizations still overstock critical spare parts “just in case,” tying up millions in working capital.

Balancing reliability with efficiency requires more than spreadsheets or disconnected ERP data. It demands AI-powered MRO inventory optimization that helps maintenance, procurement, and operations make data-backed decisions in real time.

Here’s how leading oil & gas companies are transforming their MRO strategies to reduce downtime, eliminate excess, and boost reliability.

The Cost of Unoptimized MRO Inventory in Oil & Gas

Oil & gas supply chains are among the most complex in the world. Refineries, rigs, and processing plants depend on thousands of components sourced globally. When MRO inventory data is inaccurate or disconnected, the risk multiplies:

- Hidden duplication: Identical duplicate materials stored across sites under different names.

- Unplanned downtime: Critical parts are unavailable when maintenance is due.

- Bloated inventory: Excess stock fills warehouses, locking up millions in working capital.

- Siloed decision-making: Plants operate independently, each managing its own materials and suppliers.

For one global upstream operator, the carrying cost of unused MRO materials exceeded 25 percent of total stock value annually – a silent drain on profitability.

Why Traditional MRO Approaches Fail

Most oil & gas companies rely on periodic data cleansing projects, spreadsheet audits, or site-level buying controls to manage MRO inventory. These approaches fail because:

- Data quality erodes as soon as cleansing ends.

- Maintenance and procurement decisions remain siloed.

- Duplicate parts continue to proliferate across ERP systems.

- Local buyers reorder materials already available elsewhere.

The result? Overbuying continues, while critical maintenance still gets delayed.

To solve this, leading companies are replacing reactive management with AI-driven MRO optimization software that delivers visibility across the entire network.

How AI-Powered MRO Optimization Transforms Operations

Verusen’s AI-driven platform gives oil & gas companies unified visibility into all MRO materials, regardless of ERP system or location. It identifies duplicates, highlights stockout risks, and provides real-time recommendations for right-sizing inventory across sites.

Key Capabilities

- Cross-site visibility: See available materials across plants, rigs, and suppliers.

- Duplicate detection: Automatically identify identical or equivalent materials across multiple ERP systems.

- Predictive maintenance alignment: Forecast future demand to prevent downtime.

- Working capital optimization: Free up cash from obsolete or redundant stock.

Business Impact

- 10-20 percent inventory reduction, freeing millions in working capital.

- Reduced carrying costs and fewer emergency purchases.

- Faster material location and sourcing for planned and unplanned maintenance.

- Improved uptime through proactive part availability.

By replacing reactive processes with real-time insight, oil & gas manufacturers gain both reliability and liquidity – without compromising safety.

Case Study: Fortune 500 Packaging Manufacturer

Although outside the oil & gas sector, this manufacturer’s challenge mirrors the same visibility problems that plague asset-intensive industries.

The Challenge

A Fortune 500 packaging manufacturer struggled with excess working capital, duplicate materials, and unplanned downtime after multiple acquisitions. Disconnected ERP systems made it impossible to identify shared materials across plants.

The Solution

The company deployed Verusen’s AI-powered MRO inventory optimization platform to unify data, eliminate duplication, and centralize visibility.

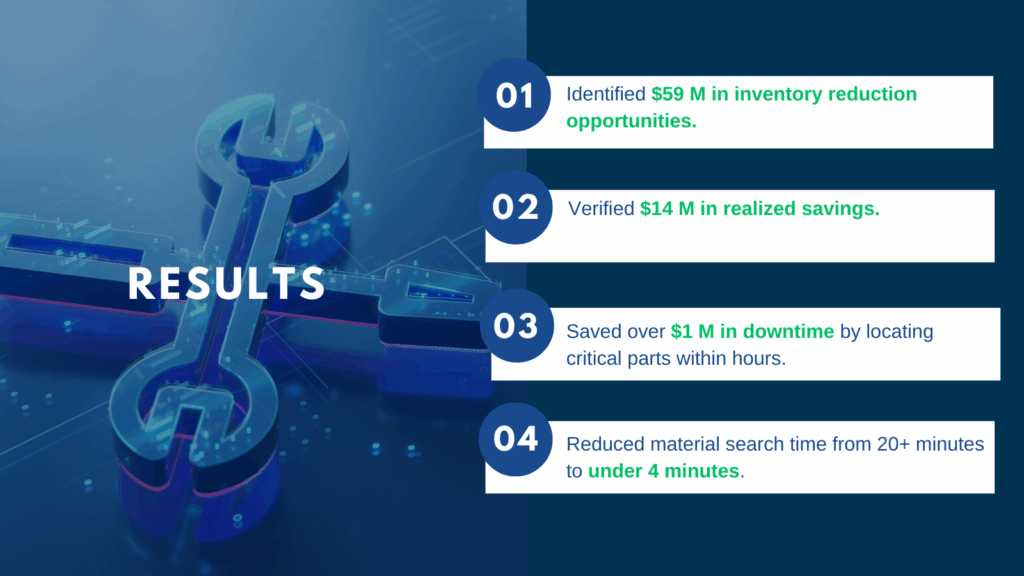

The Outcome

The result was a resilient, connected supply network – one that reduced both financial waste and operational risk. Oil & gas companies can achieve the same by applying AI visibility to their MRO operations.

Building a Resilient MRO Supply Chain in Oil & Gas

MRO optimization isn’t just about cost savings – it’s about building resilience across the supply chain. With a unified platform and AI insight, operators can:

- Prevent downtime by anticipating maintenance needs.

- Reduce inventory waste without increasing risk.

- Unify global data across multiple ERP systems.

- Make confident, data-driven decisions across procurement and maintenance.

AI transforms MRO from a static cost center into a dynamic risk management tool – ensuring that every part purchased, stocked, or deployed supports uptime and profitability.

FAQs

How does AI help reduce downtime in oil & gas operations?

AI predicts which materials are critical to upcoming maintenance, ensuring parts are available before equipment failure occurs.

Can Verusen integrate with multiple ERPs?

Yes – Verusen connects directly to SAP, Oracle, Maximo, and Infor, providing unified visibility across global sites without migration or manual data entry.

What measurable financial impact can oil & gas firms expect?

Typical results include 10-25 percent inventory reduction, freeing millions in working capital, plus measurable uptime gains within 6-12 months.

How long does implementation take?

Most enterprises achieve full visibility within 12 weeks and measurable ROI within 3-6 months.

Oil & gas leaders face relentless pressure to reduce downtime, improve reliability, and unlock working capital – often across vast, complex networks of plants and suppliers.

Verusen helps global manufacturers achieve MRO visibility, eliminate overstocking, and build supply chain resilience through AI.

Request a Risk Reduction Assessment today to see how Verusen can optimize your MRO strategy for performance and profit.